Among the 168 papers presented at NEUDC 2018, 16 were related to firms and finance, also involving themes such as networks, energy efficiency and renewable energy (EERE), and macroeconomics. Studies from the 16 papers generally focused on firm performance and its impact on economic growth outcomes. Regarding geographic focus, Asian countries (India, Vietnam, and Indonesia) appeared in seven papers; six papers concentrated on Latin America (Mexico, Costa Rica, and Columbia); two papers focused on African countries (Uganda and Kenya); and one paper provided a global examination at the city level. The findings presented at NEUDC 2018 contributed to the current literature on firms and finance and shed light on the complexity of doing business in developing countries.

Productivity, Management, and Firm Performance

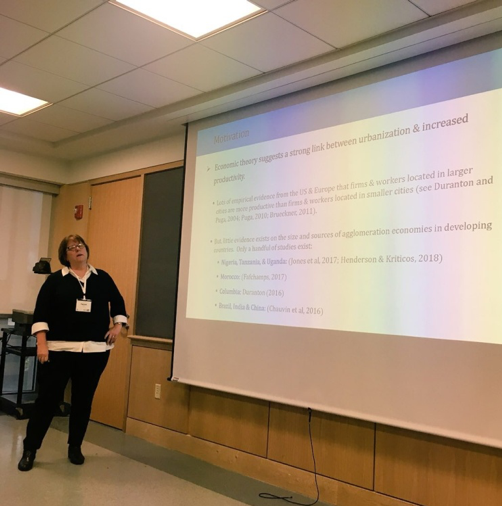

When compared with those in developed countries, firms in developing countries struggle or thrive in different ways. Finding approaches and creating an environment to improve firm productivity and management practices have always been sought-after topics. A global examination of urban productivity based on 12,000 firms in 111 cities and 51 countries revealed that African cities were generating fewer economic benefits than comparable cities in Asia and Latin America (Collier, Jones, and Spijkerman). Patricia Jones discussed how agglomeration forces played a necessary role in expanding formal sector employment at the city level. New findings from Kenya’s matatu industry indicated monitoring technology would increase employee effort and firm profits (Kelley, Lane, and Schönholzer). Vidhya Soundararajan presented an example of the Indian State of Andhra Pradesh. Her research demonstrated that banning of fixed-term contracts reduced contract labor usage in core activities and increased regular input costs as well as revenue and profits (Chaurey and Soundararajan). Social network and infrastructure are also likely to influence firm performance. Mattea Stein demonstrated that networks among small enterprise owners accelerated the dissemination of business training in Uganda (Stein). Dana Kassem examined the electricity grid expansion and firm turnover in Indonesia. Results from their research showed that electrification encouraged industrial development by increasing firm entry rates, exit rates and diversifying industry activities (Kassem).

Government, Policies, and Firm Behavior

In developing countries, small and medium enterprises (SMEs) are affected more by local policies than large firms. A study in Vietnam presented by Duong Trung Le showed that government centralization could improve firm performance for SMEs without affecting government amenities (Le). With all the constraints faced by SMEs, policies and government assistance such as grants, loans, and benefits are crucial resources to help firms grow. Ritam Chaurey presented a government program that improved infrastructure in individual districts in India. They suggested consistent access to electricity would enhance micro-enterprise profitability (Chaurey& Le). Another study of multi-product firms in India showed that the dismantling of a large, size-based industrial policy brought new opportunities for small enterprises and also increased customer welfare (Chiplunkar). Alessandro Ruggieri argued that the unemployment rate increased after trade reforms, and also that the unemployment response differed across countries. He further pointed out that lower firing costs, a statutory minimum wage, and better unemployment benefits accounted for most of the increase in unemployment (Ruggieri). However, gaining economic growth is not the only concern for governments. Taxation is another popular topic, especially investigating how to regulate tax rates and how to collect them efficiently. Tejaswi Velayudhan presented on how firms in India tend to produce less after the imposition of a value-added tax on manufacturing, i.e.,“CenVAT” (Velayudhan). In an RCT experiment conducted in Costa Rica, results showed that sending emails as tax payment reminders increased both reporting participation and the amount reported (Brockmeyer et al.).

New Trends in Financial Services

Finance services are essential for firms to operate and are critical for economic growth. Nagpurnan and Prabhala presented a study of private banks in India, in which they examined the lending consequences of the deposit flight using granular branch-level data on deposits. Their research found evidence of credit reallocation, which reflected pure panic of retail clients (Das et al.). Four papers presented looked at changes in financial services in Mexico from different perspectives. Using novel data from Mexico, Alan Finkelstein Shapiro found that large firms (defined by sales quantities and numbers of employees) tended to choose inter-firm trade credits over bank credits. The use of inter-credits helped them to smooth price variations, get lower prices, and thus win a larger market share (Shapiro et al.). Sean Higgins demonstrated that a recent expansion in the use of debit cards led more corner stores to accept debit card payment to attract new customers (Higgins). Jonathan Bauchet found that a shorter payment cycle of life insurance installments predominantly increased the demand for life insurance (Bauchet and Morduch). In a study on micro-finance, Travis Lybbert found that sharing examples of successful borrowers could increase both the courage and performance of micro-enterprises that need financing (Valdes, Wyldick, and Lybbert).

In Summary…

Firms in developing countries are often small and have short life expectancies. The findings presented at NEUDC imply, however, that we can look forward to progress in how policy in developing countries will encourage firms to continuously and sustainably enhance financial services and shape local economies.