Chris Mills is a PhD student in Economics at Princeton University and a recent graduate in Economics and Computer Science at Cornell

Pastoral populations of Sub-Saharan Africa are particularly vulnerable to environmental shocks, which contribute to livestock mortality and therefore losses in both wealth and productive assets. Although conventional insurance mechanisms covering individual losses are generally not cost effective (page 2) in low-income pastoral communities that engage in extensive grazing, index insurance for livestock offers a promising alternative. Unlike traditional loss-based insurance, index based insurance uses an external indicator to approximate losses on an aggregate level over a particular area. Index insurance is also less susceptible to moral hazard because payout is independent of an insured client’s individual behavior, and less susceptible to adverse selection because the index is created from external variables unrelated to individual-specific risk. These advantages motivate the design behind the International Livestock Research Institute’s novel index based livestock insurance (IBLI) product.

Despite its potential benefits, index insurance does not necessarily imply full — indeed any — risk coverage. Because the IBLI product is designed to cover covariate risk – risks shared by a group of people living in a particular region — individual gains or losses that deviate from the index are not compensated. An insured client, for example, might not lose any livestock during a regional drought and still be paid an indemnity. Alternatively, one could lose a significant portion of his or her herd (from disease, for instance) without receiving an indemnity. In some places, therefore, index insurance may increase the level of an insured agent’s income risk, making the IBLI product a gamble instead of a source of income smoothing.

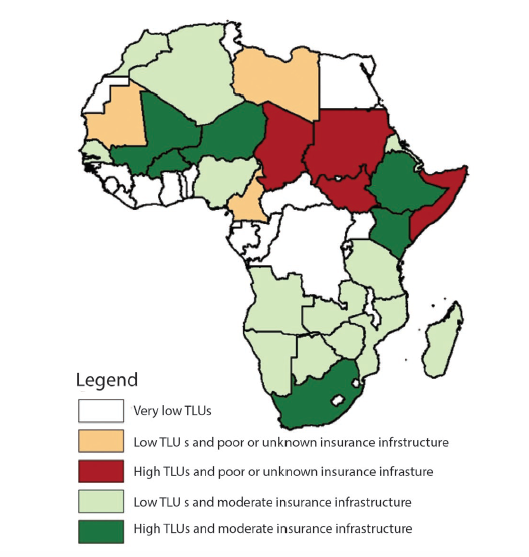

The fine line between an insurance product that covers risk and a product that produces risk motivates the need to characterize regions most suitable for index insurance. These most suitable regions exhibit high covariate risk from drought, high potential demand for a livestock insurance product, and lie in countries with. My recent paper with Nathan Jensen, Chris Barrett, and Andrew Mude offers a cursory analysis of regions where IBLI can pack the most benefit, characterizing regions where (1) extensive grazing pastoralists reside, (2) pastoralists are exposed to high covariate risk, (3) livestock supply is high (indicative of potential demand for insurance), and (4) insurance infrastructure is present.

Our analysis involves identifying a climatic target area by isolating arid, semi-arid, and dry sub-humid zones, then removing cropping areas to focus on regions more suited for extensive grazing pastoralists that are likely to face a high proportion of covariate risk from drought to total risk.

We then estimated potential demand for IBLI using geospatial data on camels, cattle, sheep, and goats generated by ILRI’s Tim Robinson, estimated using machine learning techniques applied to subnational livestock figures. The critical insight in our methodology is that we only aggregate livestock that fall within the target area, so that livestock holding counts are in theory more reflective of extensive grazing pastoral holdings and thus of intended clients for IBLI.

Finally, we determine existing capacity for a new insurance product based on country-level insurance industry data. Countries with well-developed, thick insurance markets are more likely to be able to support the successful introduction of an index based livestock insurance product than those with underdeveloped, thin markets. We generate a snapshot of insurance infrastructure using data on non-life insurance and insurance company assets from the U.S. Federal Reserve Bank of St. Louis, and supplement our findings with microinsurance reports form the MunichRe Foundation.

We first isolated areas where (1) extensive grazing pastoralists reside and (2) populations are exposed to high covariate risk from herd mortality. We then focused on (3) areas of high livestock supply (indicative of potential demand for insurance) and (4) areas with existing insurance infrastructure.

The combination of our climate, livestock supply, and insurance market (institutional) data offers a multidimensional perspective on which regions are well suited for a livestock index insurance product, such as shown in the figure above. Our preliminary characterization results provide a prioritization of areas in which to implement IBLI. Particularly salient is the presence of high-priority areas outside Kenya, Ethiopia, and Somalia. The southern administrative units of Niger, Mali, and even as far east as Mauritania all appear strong candidates for index insurance. There also appear to be potential high-priority regions south of the Zambezi River in Zimbabwe, Botswana, and South Africa. These findings motivate the collection of other region-specific data that could lend insight to sources of basis risk, and the pursuit of potential strategic partnerships within high-priority areas. Our findings will help to direct future IBLI efforts and program funding to areas where index insurance has the best chance to offer value to pastoralists.

Is it also possible with rustling as this is also practiced because of the climate change resulting factors of Hunger in some occasions.

Well insurance services are really good for settled pastoralists communities but with mobile pastoralists how possible is it.

Interesting. How do you encourage the extensive farmers into long term drought management programs ? . Such as fencing.

I appreciate this information about livestock insurance. It is good to know that climate, livestock supply, and the insurance market are all variables that go into deciding whether regions are suitable for a livestock index insurance product. It would be interesting to compare different climates and see the differences that exist.