Nouhoum Traore is a PhD candidate from the University of Wisconsin-Madison and is currently on the job market; Jeremy Foltz is a professor at the University of Wisconsin-Madison

As global temperatures rise, it is increasingly important to understand the effects of temperature on economic productivity. A growing body of work has established a strong negative relationship between historical fluctuations in temperature levels and aggregate economic performance (Dell et al., 2012; Burke et al., 2015). While this work has not yet focused on Africa, there are good reasons to believe that African firms are vulnerable to climate change due to missing credit and insurance markets and the high vulnerability of their agriculture sector to weather conditions. Moreover, if non-agricultural sectors are expected to attenuate the effects of climate change by absorbing affected workers from the agricultural sector, it is important to understand how temperatures might also affect non-agricultural sectors.

In this paper, we use a unique, detailed, firm-level dataset from Ivory Coast that captures multiple sectors of the economy, to examine the effects of temperatures on firms’ outcomes and investigate the channel through which such effects take place. First, we adapt a trade model with heterogeneous firms to analyze the impact of increased temperatures on firm revenues, profits, and survival. Second, we estimate total factor productivity (TFP) non-parametrically, using the most recent techniques in the field of industrial organization.

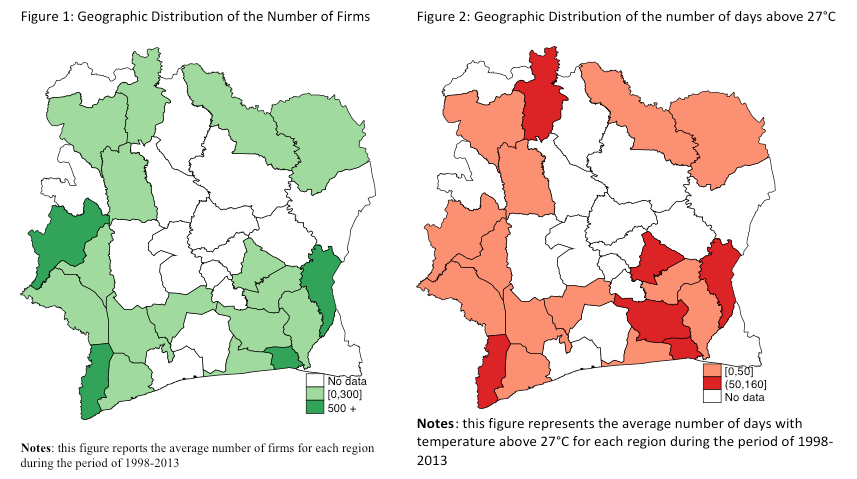

To offer some insights on the area of study, Figure 1 depicts the average number of firms in each region of Ivory Coast during the period of 1998-2013. While there is a large presence of firms in coastal regions, especially in Abidjan and San-Pedro, as well as a number of firms in the north and in the west, there is no formal economic activity in the center of the country; regions without formal economic activity are not considered in this analysis. We define our high temperature variable to be the number of days per year with average temperatures above 27C. The regional heterogeneity in the number of days within each temperature bin is depicted in Figure 2. More hot days are observed in both the north and the south of the country.

Third, we empirically investigate whether and how temperatures affect firm productivity. Our empirical strategy for studying the impact of temperatures on firms’ performance is to regress the variables of interest (TFP, firm revenues, profits, exit, labor, capital productivity) on the temperature variables constructed using the bin approach and other control variables, including firm fixed effects. Temperature and precipitation variables are constructed using daily observations. To facilitate the comparison of our results with previous work, we define 3 temperature bins, the number of days below 25C, between 25C and 27C, and above 27C. Finally, we test the key prediction from our model that increased temperatures decrease firms’ revenues, profits, and market survival rate.

In our main results, estimated using exogenous variation in temperatures overtime and controlling for firm fixed effects and time trends, we find that each extra day with average high temperatures decreases a firm’s annual revenues, profits, and TFP, respectively, by 0.28%, 0.20%, and 0.07% relative to the impact of a day with moderate average temperatures. We also found a significant effect of high temperatures on firm exit rate (Table 1).

What are the mechanisms through which higher temperatures affect firm productivity? To assess the potential mechanisms, we estimate the effects of temperature on labor and capital productivity. Results in columns (1) and (2) of Table 2 suggest that a one-standard-deviation rise in days with higher temperatures reduces labor and capital productivity by 6.25% and 22.74%, respectively. Using average labor and capital elasticity from our productivity estimations, the weighted sum of the effect of temperatures on labor and capital productivity suggest that a one-standard- deviation rise in days with high temperatures reduces firm productivity by 5.97% and 2.16% respectively. These effects are in the range of what we found in our main results as the effects of high temperatures on TFP. These results provide strong evidence that temperatures affect capital productivity, a channel that has not been well explored in the literature.

In column (3) of table 2, labor-intensive firms are classified as firms with the ratio of initial labor over initial sales above the mean value. In the absence of direct observation of firm investment choice in climate mitigation technology (e.g. AC), we exploit firm level of fixed and financial assets as an empirical proxy to indicate firms that can invest in the technology (Column 4). While we find evidence that labor intensive and small firms are more affected by temperatures, our findings suggest that firms that can invest in climate mitigation technology (e.g. air conditioner) are less affected. For instance, the effect of one-standard-deviation rise in days with high temperature on revenues is reduced by 8.73% (more than half of the total effects) for firms investing in climate mitigation technology compared to those that do not. In other words, this result suggests that while temperatures affect economic activity, they affect economic entities heterogeneously.

The findings in this paper show that climate change and an increase in the number of hot temperature days may also affect the productivity and competitiveness of firms in the non-agricultural sector while also highlighting the role that climate mitigation technologies can play in attenuating these effects. Neglecting these two factors will result in inaccurate measures of the impact of changes in temperature on economic activity. Second, while temperature affects all firms, labor-intensive and small firms with less capital are the most vulnerable to these changes. Thus, climate policy in developing countries should aim to facilitate the use of adaption technology by firms while paying particular attention to labor-intensive and small firms.

We sincerely thank Enghin Atalay, Ian Coxhead, Akiko Suwa-Eisenmann, Kenneth D. West, Karen Macours, Denis Cogneau, Sylvie Lambert, David Margolis, Francois Libois, and seminar participants at PSE, Wisconsin-Madison, for very useful comments, discussion, and help. We are grateful to Francois Bourguignon and the National Institute of Statistics of Ivory Coast for providing us the data. This paper’s findings, interpretation, and conclusions are entirely those of the authors. This paper is funded under the grant “Policy Design and Evaluation Research in Developing Countries” Initial Training Network (PODER), which is funded under the Marie Curie Actions of the EU’s Seventh Framework Programme (Contract Number: 608109).